Cloud-based tax preparation software is revolutionizing the way tax professionals handle their work. Offering unparalleled convenience, security, and efficiency, these tools are essential for modern tax practices. This comprehensive guide explores everything to know about cloud-based tax preparation software to help you understand why it’s a game-changer for your business.

What Is Cloud-Based Tax Preparation Software?

Cloud-based tax preparation software allows you to prepare, file, and manage taxes online through a secure internet connection. Unlike traditional desktop applications, cloud-based solutions store data on remote servers, providing access from any device with internet connectivity. This flexibility is ideal if you need to work from multiple locations or collaborate with colleagues and clients remotely.

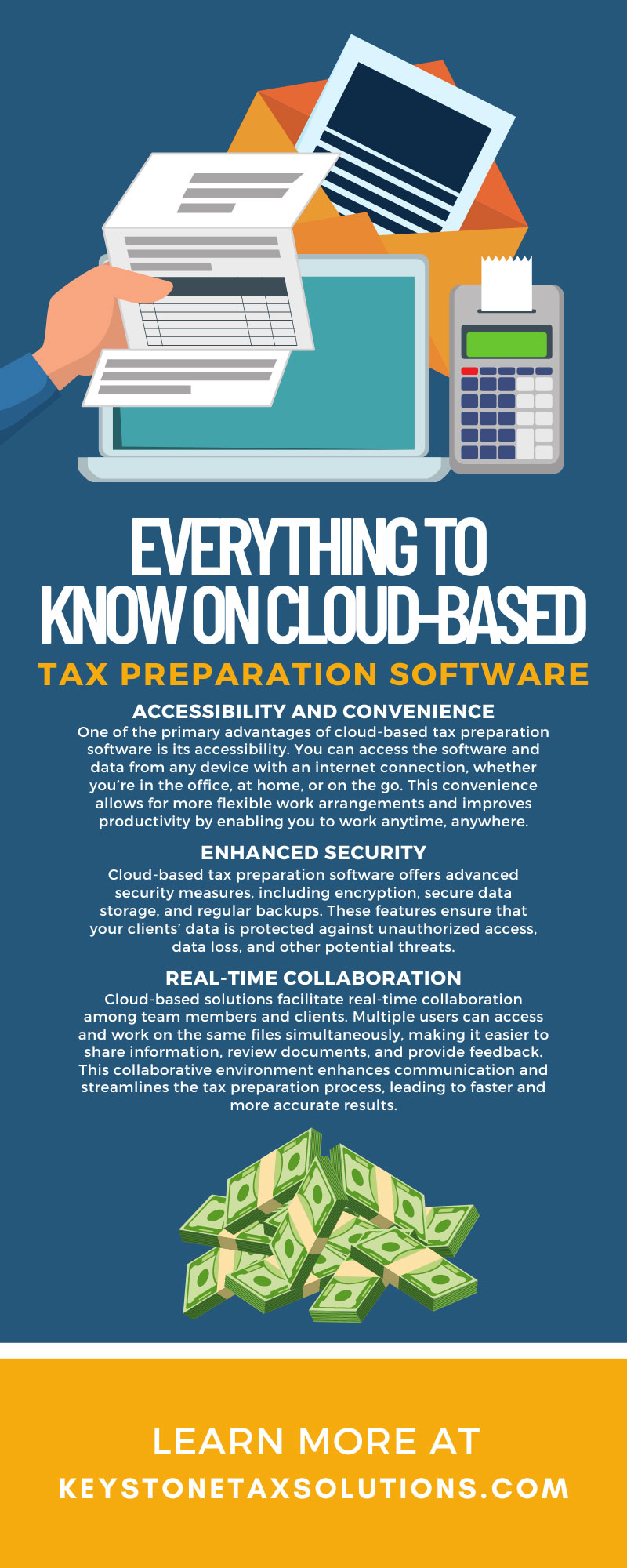

Accessibility and Convenience

One of the primary advantages of cloud-based tax preparation software is its accessibility. As mentioned, you can access the software and data from any device with an internet connection, whether you’re in the office, at home, or on the go. This convenience allows for more flexible work arrangements and improves productivity by enabling you to work anytime, anywhere.

Enhanced Security

Security is a top concern for any tax professional handling sensitive client information. Cloud-based tax preparation software offers advanced security measures, including encryption, secure data storage, and regular backups. These features ensure that your clients’ data is protected against unauthorized access, data loss, and other potential threats. Additionally, reputable cloud service providers comply with industry standards and regulations to safeguard that data.

Real-Time Collaboration

Cloud-based solutions facilitate real-time collaboration among team members and clients. Multiple users can access and work on the same files simultaneously, making it easier to share information, review documents, and provide feedback. This collaborative environment enhances communication and streamlines the tax preparation process, leading to faster and more accurate results.

Automatic Updates

One significant advantage of cloud-based software is the updates that are performed automatically. Unlike desktop applications that require manual updates, cloud-based solutions are updated by the service provider. This ensures that you always have access to the latest features, security patches, and tax law changes without the hassle of manual installations. Staying current with updates helps you maintain compliance and improves the software’s performance.

Cost-Effectiveness

Cloud-based tax preparation software can be more cost-effective than traditional desktop software. With cloud solutions, there are no upfront costs for hardware or software installations. Instead, you typically pay a subscription fee that covers software usage, updates, and support. This subscription model can be more budget-friendly, especially for small to mid-sized tax practices, as it spreads costs over time and eliminates the need for significant initial investments.

Scalability

Scalability is a key feature of cloud-based tax preparation software. As your business grows, you can easily scale up your software usage by adding more users or increasing storage capacity. This flexibility ensures that your software can adapt to your evolving needs without requiring a complete system overhaul. Scalability makes cloud-based solutions ideal for growing tax practices that need to accommodate increasing workloads.

Integration With Other Tools

Cloud-based tax preparation software often integrates seamlessly with other essential tools and applications, such as accounting software, client management systems, and electronic signature solutions. These integrations streamline workflows by enabling data to flow smoothly between different platforms. This connectivity reduces manual data entry, minimizes errors, and enhances overall efficiency in your tax practice.

Enhanced Data Management

Efficient data management is crucial for tax professionals. Cloud-based solutions provide robust data management features, including centralized data storage, easy retrieval, and powerful search capabilities. These features ensure that you can quickly access the information you need, improving the accuracy and speed of your tax preparation work. Additionally, cloud storage reduces the risk of data loss due to hardware failures or other local issues.

Disaster Recovery

Cloud-based tax preparation software offers robust disaster recovery options. Data stored in the cloud is regularly backed up by the service provider, ensuring that your clients’ information is safe even in the event of a hardware failure, natural disaster, or cyberattack. This level of data protection gives you peace of mind and ensures business continuity, allowing you to focus on serving your clients without worrying about data loss.

Compliance and Regulatory Updates

Keeping up with constantly changing tax laws and regulations is challenging. Cloud-based tax preparation software helps you stay compliant by automatically incorporating the latest regulatory updates and tax law changes. This feature ensures that your tax filings are accurate and up to date, reducing the risk of errors and penalties. Staying compliant with current regulations is essential for maintaining the integrity and reputation of your tax practice.

Improved Client Experience

Using cloud-based tax preparation software can enhance the client experience. Your clients can securely upload documents, review tax returns, and communicate with you online. This level of convenience and transparency builds trust and satisfaction, encouraging client loyalty and referrals. A smooth and efficient tax preparation process demonstrates your commitment to providing excellent service.

User-Friendly Interface

Modern cloud-based tax preparation software features user-friendly interfaces designed to simplify the tax preparation process. Intuitive navigation, clear instructions, and helpful support resources make it easier for you to use the software effectively. A user-friendly interface reduces the learning curve, allowing you to focus on your core tasks and improve productivity.

Mobile Accessibility

With the increasing use of mobile devices, having access to your tax preparation software on a smartphone or tablet is a significant advantage. Cloud-based solutions offer mobile accessibility, allowing you to manage your tax preparation tasks from anywhere. This flexibility is especially useful if you need to travel or work remotely, ensuring that you can stay productive regardless of your location.

Web-Based Professional Tax Software

Web-based professional tax software combines all the advantages of cloud computing with specialized features tailored to tax professionals. These solutions offer comprehensive tools for tax preparation, filing, and client management, and they’re all accessible through a secure web interface. By investing in web-based professional tax software, you can streamline your workflow, enhance data security, and provide exceptional service to your clients.

After reviewing everything to know about cloud-based tax preparation software, you can make an informed decision that will enhance your tax practice. By adopting web-based professional tax software, you can streamline your operations, stay compliant with regulatory updates, and provide top-notch service to your clients. Embrace the future of tax preparation with cloud-based solutions and take your practice to the next level.