Common Misconceptions About Tax Service Bureaus

Discover some common misconceptions about tax service bureaus and learn the facts behind this important tax solution with our detailed guide.

Discover some common misconceptions about tax service bureaus and learn the facts behind this important tax solution with our detailed guide.

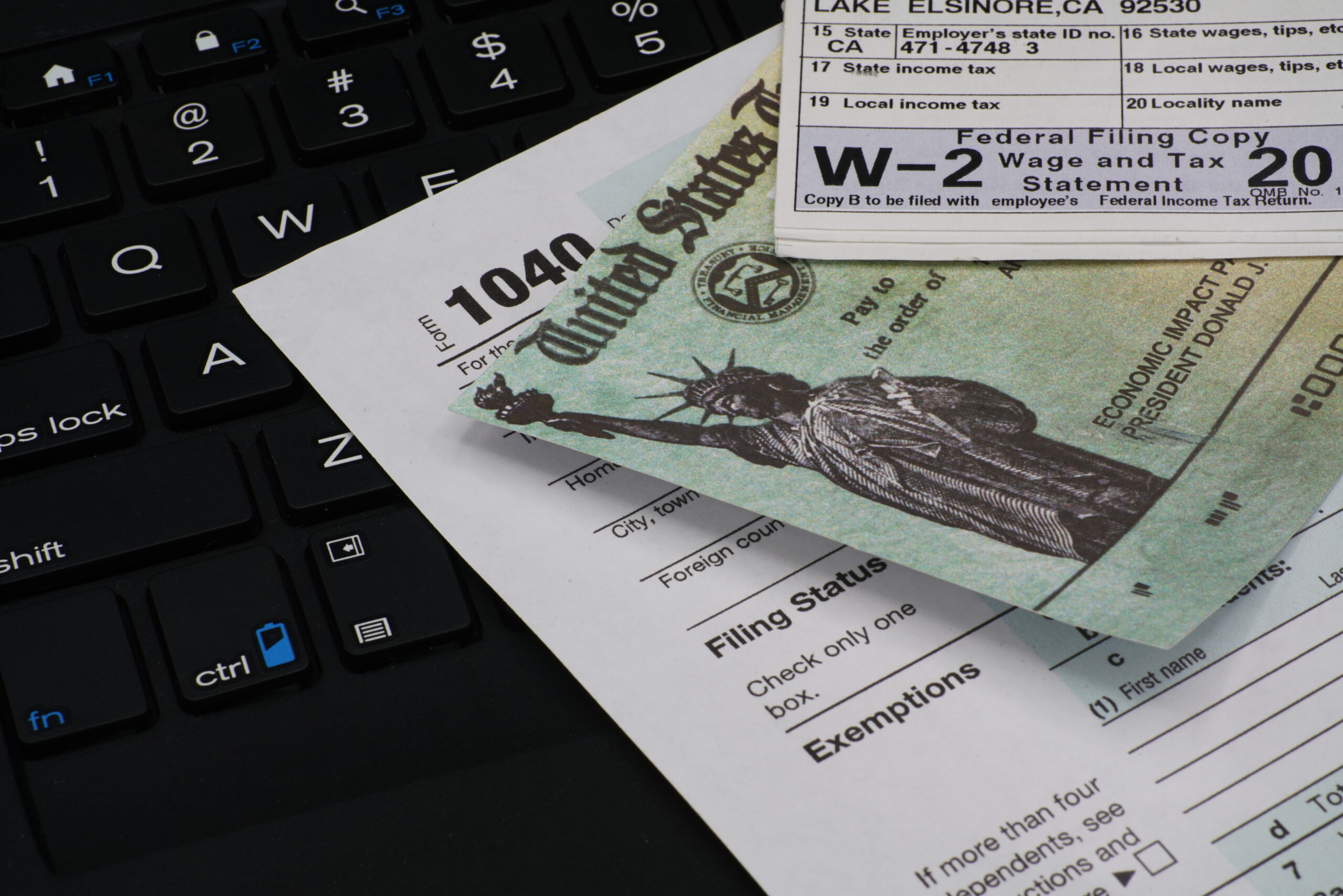

Learn how bank products help tax clients receive refunds faster and simplify their filing experience. Discover benefits for tax professionals and clients alike.

Discover why document management is essential for tax professionals. Learn how it ensures compliance, streamlines workflow, and integrates with tax software.

Discover what tax bank preparations are and how they streamline taxes. Learn about tax bank products, their benefits, and the role of tax preparation software.

Discover everything you need to know about running a tax service bureau, from startup essentials and client management to marketing strategies and compliance.

Discover professional tips for retaining tax clients, including exceptional service, tax law updates, year-round support, and leveraging advanced tax software.

Discover why mobile tax apps are gaining popularity. Learn about their convenience, real-time updates, security features, and integration with financial tools.

Expand your tax business with additional services, like bookkeeping, financial planning, and payroll, to enhance client satisfaction and boost revenue.

Everything To Know on Cloud-Based Tax Preparation Software

Discover how bank products can enhance clients’ financial health with our insights on savings accounts, credit options, financial planning, and tax preparation.

Explore the essential education requirements for tax professionals, and discover how you can meet these standards to survive and thrive in your career.

Discover the essential tax forms every tax professional needs for their clients—from individual returns to business filings—and streamline your processes.

Maximize the benefits of your tax bank preparation services with these four essential tips, from organizing documents to leveraging tax software resellers.

Discover how mobile tax apps simplify filing season, enhance accuracy, and save time for individuals and tax professionals. Learn about key features here.

Discover why tax preparation software is crucial for accuracy and compliance in handling taxes, and explore the advantages of cloud-based solutions.

Understand what to expect from tax bank preparation services, from comprehensive filing assistance to innovative tax bank products that enhance your experience.

Learn how to start a tax preparation business with minimal investment. This guide covers everything from acquiring qualifications to marketing your services.

Avoid common tax filing errors with this guide. Learn how incorrect filing statuses, missing information, and not using the right tools can impact your taxes.

Discover essential strategies for tax preparers to safeguard client information, from utilizing strong encryption to choosing secure tax preparation apps.

Start your virtual tax preparation business successfully with our comprehensive guide. Learn about choosing software, marketing strategies, and more.

Enhance your tax preparation business with essential sales skills. Learn how to communicate, build trust, upsell services, and utilize technology for success.

Explore the benefits of cloud-based vs. desktop-based tax software, including security, cost-effectiveness, and the latest innovations in tax preparation.

Discover the top reasons your small tax business might be struggling, from lack of modern technology to not using tax software with no EFIN required.

Elevate your tax preparation business with these four effective growth strategies, including leveraging technology and expanding your service offerings.

Discover the top tax return filing errors professional tax preparers should avoid, from overlooking income to not using technology effectively.

Discover how to become a tax service bureau with our comprehensive guide, including key steps, certification, and tips for success in tax preparation.

Discover the top tax prep tools that can transform your tax practice. From advanced software to client communication platforms, enhance efficiency and accuracy.

Discover key strategies for hiring the right team for your tax business. Enhance your hiring process with our expert tips, from vetting to technology.

Discover the essential steps to becoming a skilled tax preparer with our guide, covering education, certification, software, and practical tips for success.

Unlock the potential of R&D tax credits for your clients with our essential tips regarding eligibility, documentation, and maximizing benefits.

Copyright © Keystone Tax Solutions 2024. All Rights Reserved.