Starting a virtual tax preparation business can be a lucrative endeavor, especially as more clients value the convenience of online services. This guide will walk you through the essential steps to establish, manage, and grow your virtual tax service effectively, ensuring you meet the needs of your clients while adhering to regulatory standards. Read on for our guide to starting a virtual tax preparation business.

Understand the Market

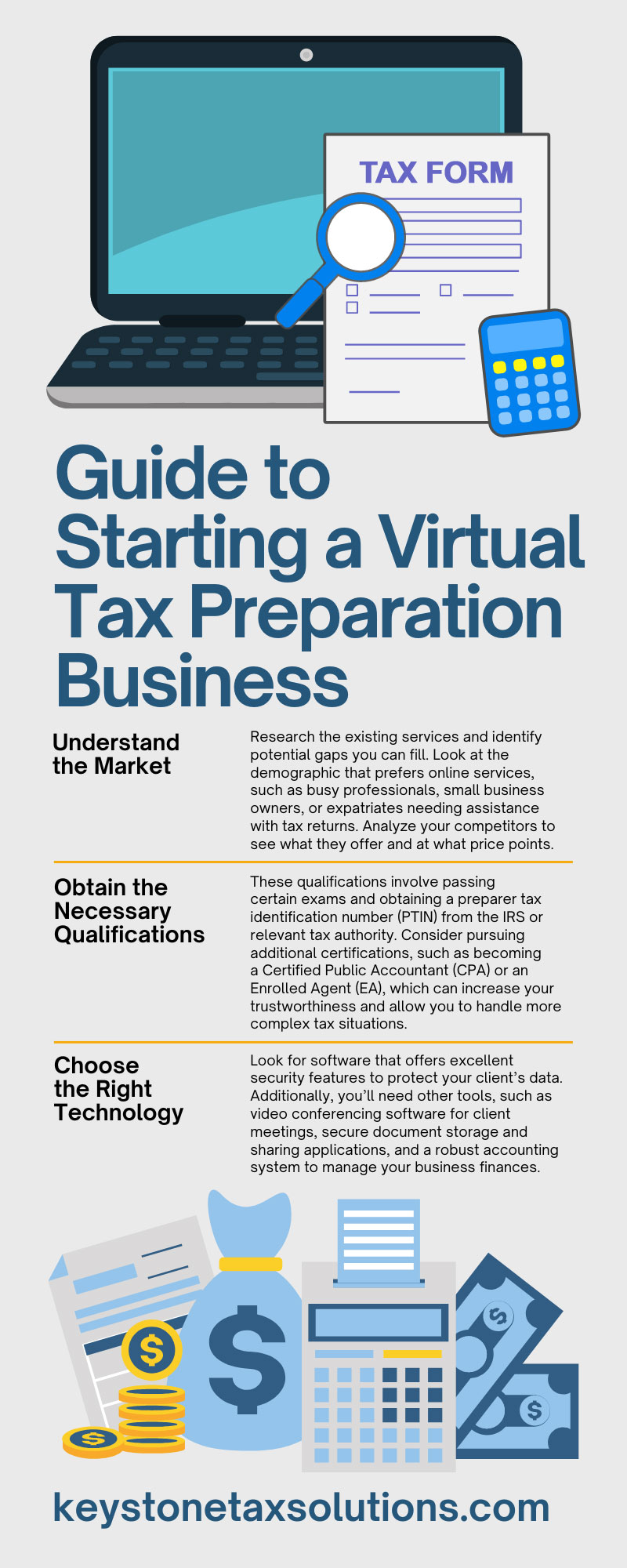

Understanding the market before launching your virtual tax preparation business is crucial. Research the existing services and identify potential gaps you can fill. Look at the demographic that prefers online services, such as busy professionals, small business owners, or expatriates needing assistance with tax returns. Analyze your competitors to see what they offer and at what price points. This initial research will help you tailor your services to meet specific needs and stand out in a crowded market.

Obtain the Necessary Qualifications

You must have the appropriate qualifications to operate a credible tax preparation business. These qualifications involve passing certain exams and obtaining a preparer tax identification number (PTIN) from the IRS or relevant tax authority. Consider pursuing additional certifications, such as becoming a Certified Public Accountant (CPA) or an Enrolled Agent (EA), which can increase your trustworthiness and allow you to handle more complex tax situations.

Choose the Right Technology

Selecting the right technology is pivotal for a virtual business. You will need reliable tax preparation software that is compliant with the latest tax laws and regulations. Look for software that offers excellent security features to protect your client’s data. Additionally, you’ll need other tools, such as video conferencing software for client meetings, secure document storage and sharing applications, and a robust accounting system to manage your business finances.

Set Up a Secure and Functional Website

Your website is often the first point of contact for potential clients, so it must be professional, user-friendly, and secure. It should provide easy navigation, detailed information about your services, and a secure portal for clients to upload sensitive documents. Ensure you optimize your website for search engines to increase your visibility online. Investing in SSL certificates to secure client data and improve your site’s trustworthiness is also essential.

Establish Clear Communication Channels

Effective communication is key to running a successful virtual tax preparation business. Establish clear channels through which clients can reach you, such as email, phone, or even chat systems on your website. Set expectations early on about response times and stick to them. Providing multiple ways for clients to contact you can enhance customer satisfaction and help build long-lasting relationships.

Develop a Pricing Strategy

Your pricing strategy should reflect the complexity of the services you offer and the clientele you target. Consider offering tiered pricing based on the simplicity or complexity of the tax returns. Transparent pricing eliminates confusion and builds trust. You might also want to consider value-based pricing if you are offering specialized services that demonstrate clear ROI for your clients.

Marketing Your Business

Effective marketing is crucial to attract clients to your virtual tax preparation business. Develop a marketing strategy that includes online and offline methods. Use social media platforms, online advertising, and email marketing to reach a broad audience. Networking with other professionals, such as financial advisors and attorneys, can also help refer clients who require tax preparation services.

Optimize for Remote Service Delivery

Since your business is virtual, optimizing for remote delivery is crucial. Such optimization includes having a process for secure document exchange, a protocol for virtual meetings, and ensuring you have backup systems in place for data and service continuity. Practice good cybersecurity hygiene by regularly updating your software, using strong passwords, and educating clients on secure practices for sharing information.

Stay Updated With Tax Laws

Tax laws change frequently, and staying updated is necessary to provide accurate and effective service. Subscribe to updates from tax authorities and participate in relevant training and webinars. Being knowledgeable about the latest changes helps you serve your clients better and establishes you as an expert in your field.

Focus on Customer Service

Excellent customer service can set you apart from your competitors. Therefore, be responsive, offer personalized services, and go above and beyond to assist your clients. Consider implementing a feedback system to learn from clients’ experiences and continuously improve your services.

Implement Robust Security Measures

Security is paramount in a tax preparation business due to the sensitive nature of the information handled. Invest in top-notch security measures to protect your client’s data. Use encrypted communication, secure file transfer protocols, and multi-factor authentication. Regularly review and update your security practices to address new threats.

Prepare for the Busy Season

Tax season can be extremely busy, so it’s important to prepare. This preparation involves scaling up your resources to handle increased demand, ensuring your technology is fully operational, and pre-scheduling appointments to manage workload effectively. Preparing early helps avoid last-minute hitches and ensures smooth operation during peak times.

Networking and Partnerships

Building a network can significantly enhance your business’s reach and reputation. Join professional organizations, online forums, and local business groups. Partnerships with other financial professionals can also provide mutual benefits, including referrals and shared expertise. Networking builds not just business opportunities but also professional credibility.

Continuous Learning and Improvement

The field of tax preparation requires continuous learning and adaptation. Regularly assess your business performance and seek feedback from clients to improve. Keep learning about new technologies, advanced tax strategies, and management practices that can enhance your business operations and service delivery.

Choosing Professional Tax Preparation Software With Bank Products

Consider options that integrate professional tax preparation software with bank products when selecting your tax preparation software. These integrations allow you to offer additional services, such as refund transfers and advance loans, which can be attractive to clients expecting refunds. Such software solutions streamline your services and can provide a competitive edge by offering comprehensive financial solutions under one roof.

Now that you know how to start a virtual tax preparation business, from selecting the right technology to implementing robust security measures, you can build a successful service. Remember, continuous improvement and staying updated with tax laws are key to maintaining reliability and professionalism. Your dedication to quality service will define your success in the virtual tax preparation industry, whether you’re handling straightforward individual returns or complex corporate taxes.