Filing taxes can be a daunting task for many, but mobile tax apps have revolutionized the process, making it more accessible, efficient, and accurate. These apps offer numerous features that simplify tax filing for both individuals and professionals. Read on to explore how mobile tax apps help during the filing season, gaining insights into their benefits and functionalities.

Easy Data Entry

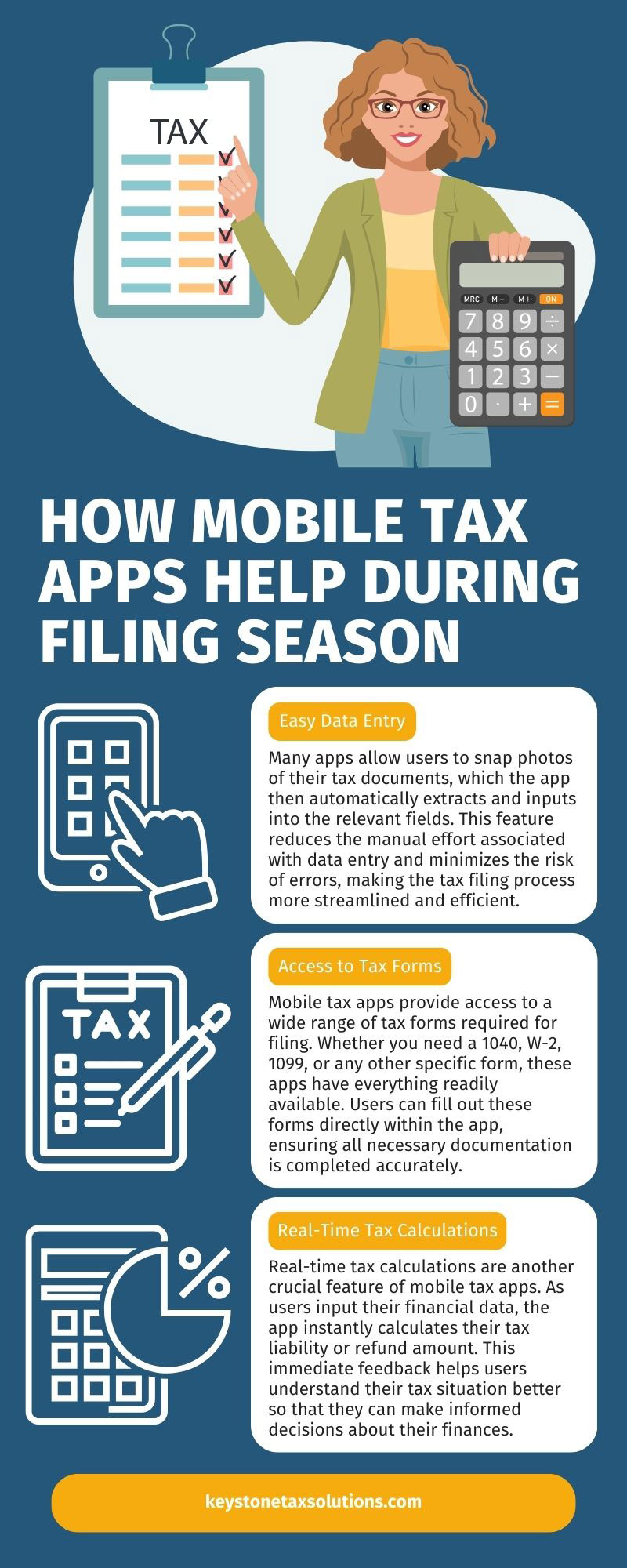

One of the most significant advantages of mobile tax apps is the ease of data entry. Users can quickly input their personal information, income details, and deductions using intuitive interfaces. Many apps allow users to snap photos of their tax documents, which the app then automatically extracts and inputs into the relevant fields. This feature reduces the manual effort associated with data entry and minimizes the risk of errors, making the tax filing process more streamlined and efficient.

Access to Tax Forms

Mobile tax apps provide access to a wide range of tax forms required for filing. Whether you need a 1040, W-2, 1099, or any other specific form, these apps have everything readily available. Users can fill out these forms directly within the app, ensuring all necessary documentation is completed accurately. This accessibility eliminates the need to search for and download forms from multiple sources, saving time and effort.

Real-Time Tax Calculations

Real-time tax calculations are another crucial feature of mobile tax apps. As users input their financial data, the app instantly calculates their tax liability or refund amount. This immediate feedback helps users understand their tax situation better so that they can make informed decisions about their finances. Real-time calculations also reduce the chances of errors and discrepancies, ensuring the final tax return is accurate.

Document Storage and Organization

Keeping track of various tax documents can be challenging, but mobile tax apps simplify this task with built-in document storage and organization features. Users can upload and store digital copies of their tax documents, receipts, and other relevant files within the app. This centralized storage ensures all necessary information is easily accessible when needed, reducing the likelihood of misplaced or forgotten documents.

Enhanced Accuracy

Accuracy is paramount when filing taxes, and mobile tax apps help ensure all data is correct. Many apps include built-in error-checking and validation features that alert users to potential mistakes or missing information. These checks help prevent common errors that could lead to audits or penalties. Additionally, the ability to import data from previous years’ returns can further enhance accuracy by ensuring consistency in reporting.

Secure Data Handling

Security is a top priority for any digital platform handling sensitive information, and mobile tax apps are no exception. These apps employ advanced encryption methods to protect users’ personal and financial data. Features such as multi-factor authentication and secure login processes add extra layers of security. Users can file their taxes with confidence, knowing that their information is safeguarded against unauthorized access.

Time Savings

The convenience of mobile tax apps translates into significant time savings. Users can complete their tax returns at their own pace without the need to schedule appointments or wait for office hours. The streamlined processes and automated features reduce the time spent on data entry and calculations. This efficiency is especially beneficial for busy individuals and professionals who need to maximize their productivity during the hectic filing season.

User-Friendly Interface

A user-friendly interface is a hallmark of effective mobile tax apps. These apps are designed to be intuitive and easy to navigate, even for users with limited technical skills. Clear instructions and guided steps help users understand what information is required and how to input it correctly. This simplicity enhances the overall user experience, making tax filing less intimidating and more accessible to a broader audience.

Integration With Financial Accounts

Many mobile tax apps offer integration with users’ financial accounts, such as bank accounts and investment portfolios. This integration allows for the automatic import of financial data, reducing manual entry and the risk of errors. Users can link their accounts securely and allow access to relevant information, such as interest income and investment gains, which will automatically populate in their tax forms. This seamless integration streamlines the tax preparation process and ensures comprehensive reporting.

Support and Assistance

Mobile tax apps often provide robust support and assistance features to help users navigate the complexities of tax filing. In-app chat support, FAQs, and help articles are commonly available to address user queries. Some apps also offer access to live tax experts who can provide personalized advice and guidance. This support ensures users have the resources they need to file their taxes accurately and confidently.

Cost-Effective Solution

Using mobile tax apps can be a cost-effective solution compared to traditional tax preparation methods. Many apps offer free or low-cost filing options for simple returns, making them accessible to a wide range of users. For more complex returns, the cost is often lower than hiring a tax professional. The value provided by these apps in terms of time savings, convenience, and accuracy makes them an attractive option for many taxpayers.

Flexibility and Convenience

Mobile tax apps offer unparalleled flexibility and convenience, allowing users to file their taxes anytime and anywhere. Whether at home, at work, or on the go, users can access their tax information and complete their returns using their mobile devices. This flexibility is particularly beneficial for individuals with busy schedules or those who need to manage their taxes outside of traditional office hours.

Tax Planning and Insights

In addition to tax filing, many mobile tax apps offer tax planning and insights features. Users can gain a better understanding of their financial situation through year-round tracking of income, expenses, and deductions. These insights help users plan for future tax liabilities and make informed financial decisions. Some apps also provide personalized recommendations for tax-saving strategies, further enhancing their value.

Eco-Friendly Option

Mobile tax apps are an eco-friendly option that reduces the need for paper forms and physical document storage. Digitizing the tax filing process contributes to environmental sustainability by minimizing paper waste. Additionally, the ability to store documents electronically reduces the need for physical storage space, making it a practical choice for those looking to reduce their environmental footprint.

Professional Use of Mobile Apps

Mobile apps for tax professionals can streamline workflow and improve client service. These apps offer advanced features such as secure client portals, electronic signatures, and collaborative tools that facilitate efficient communication and document sharing. By leveraging mobile technology, tax professionals can provide timely and accurate services, enhancing client satisfaction and business growth.

Now that you know how mobile tax apps help during filing season, you can appreciate the significant benefits they offer in terms of convenience, accuracy, and efficiency. Whether you are an individual filer or a tax professional, incorporating mobile tax apps into your routine can simplify your tasks and ensure a smoother, more accurate filing experience. Embrace the advantages of mobile tax apps for tax professionals and enjoy a stress-free tax season.