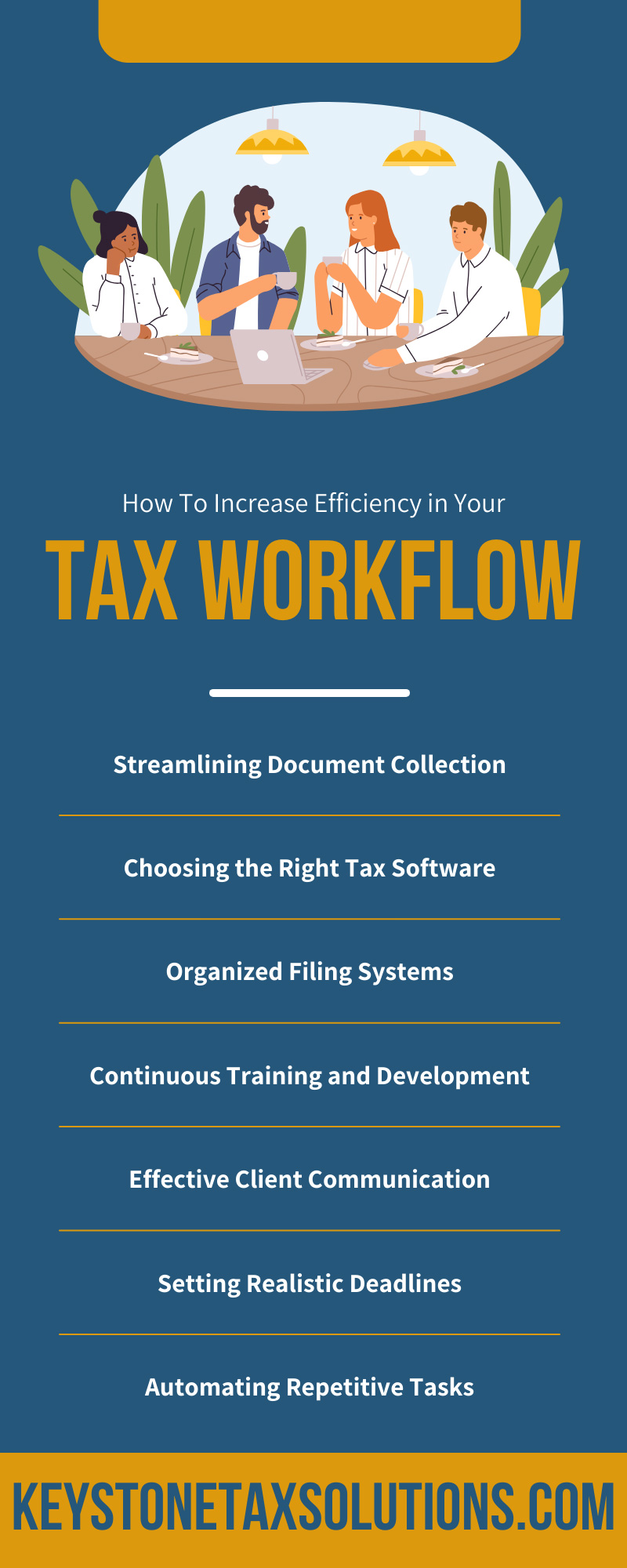

In the fast-paced world of tax preparation, efficiency is key. A streamlined workflow saves time, ensures accuracy, and enhances client satisfaction. This guide offers detailed insights for increasing efficiency in your tax workflow, integrating modern tools such as the Taxes to Go mobile app for optimal efficiency.

Streamlining Document Collection

Efficient document collection is essential for a smooth tax preparation process. Leverage digital tools that allow clients to upload documents directly to streamline this step. This method is quicker and reduces the risk of losing physical documents. Implement a secure client portal with clear instructions on how to upload documents. Ensure this portal is user-friendly and accessible. This digital approach speeds up the initial stages of tax preparation and sets the stage for a more efficient workflow, saving time for both the tax professional and the client.

Choosing the Right Tax Software

Selecting the appropriate tax software is vital for an efficient tax workflow. It should be intuitive, comprehensive, and up-to-date to comply with the latest tax regulations. Key features to look for include automated calculations, error-checking algorithms, a user-friendly interface, and integration capabilities with other financial software. Quality tax software streamlines the tax preparation process while minimizing errors, thereby increasing efficiency and reducing the time spent on manual calculations and corrections.

Organized Filing Systems

Maintaining an organized filing system, both digital and physical, is crucial for efficiency. Develop a consistent system for naming and storing files and utilize digital folders and subfolders for easy categorization and retrieval. Ensure your physical workspace is orderly, with important documents filed systematically for quick access. Taking an organized approach minimizes time spent searching for information and contributes to a more efficient tax preparation process, allowing quicker response times to client inquiries.

Continuous Training and Development

Continual training and development are key to maintaining a high level of proficiency in the rapidly evolving field of tax preparation. Regular updates and training on new tax laws, software updates, and industry best practices are essential. Encourage your team to attend webinars, workshops, and certification courses. This continuous learning approach ensures that the team remains knowledgeable and proficient, thereby enhancing the overall efficiency and accuracy of the tax preparation process.

Effective Client Communication

Clear and efficient communication with clients is critical in the tax workflow. Use tools such as emails, secure messaging platforms, or client portals to maintain consistent communication. Clear communication regarding document requirements, deadlines, and any queries ensures that there are no delays in the tax preparation process. Effective communication builds client trust and facilitates a smoother workflow, as timely information exchange is crucial for meeting filing deadlines and addressing client concerns.

Setting Realistic Deadlines

Setting realistic deadlines is a critical aspect of managing a tax workflow efficiently. Begin by assessing the complexity of each task and allocate adequate time for completion. Clearly communicate these deadlines to your team and clients, ensuring they understand the importance of adhering to them. Consider buffer periods for unforeseen delays and high-traffic periods, including tax season. Realistic deadlines prevent burnout, maintain quality standards, and enhance client satisfaction by avoiding last-minute rushes and ensuring timely delivery.

Automating Repetitive Tasks

Automation in tax workflow mainly involves identifying repetitive and time-consuming tasks that require minimal human judgment. Tools and software that automate data entry, client reminders, and basic calculations can significantly streamline these processes. Automation reduces the chance of human error, frees up valuable time for more complex tasks, and increases overall workflow efficiency. Regularly assess your processes to identify new automation opportunities, keeping up with technological advancements in tax software.

Effective Delegation and Teamwork

Effective delegation and teamwork involve understanding the strengths and weaknesses of your team and assigning tasks accordingly. Establish a culture where team members can collaborate and support each other. Encourage open communication for sharing knowledge and solutions to common challenges. Regular team meetings can help track progress, address issues, and realign goals. Effective delegation and teamwork can optimize workflow and create a more engaging and supportive work environment.

Conducting Regular Workflow Reviews

Regularly reviewing your tax workflow is vital for continuous improvement. Start by analyzing each step of your process for potential delays, errors, or inefficiencies. Gather feedback from team members and clients to gain different perspectives on the workflow’s effectiveness. Implement changes based on this feedback and track the outcomes to ensure they yield positive results. Regular workflow reviews help adapt to changing environments and maintain a competitive edge in the tax preparation industry.

Keeping Up-to-Date on Tax Laws

Staying current with tax laws and regulations is non-negotiable in the tax preparation industry. Changes in laws can significantly impact tax filing processes and client advisories. Subscribe to tax law updates, attend relevant seminars, and participate in training programs. These habits help you ensure compliance and position yourself as a knowledgeable and reliable professional in the eyes of your clients, enhancing trust and credibility.

Ensuring Data Security and Backup

In the digital age, data security and backup are paramount in the tax preparation process. Implement robust cybersecurity measures such as firewalls, encryption, and secure client portals to protect sensitive information. Regularly back up data to prevent losses due to system failures or cyber-attacks. Educate your team about cybersecurity best practices to create a secure working environment. Ensuring the security and integrity of client data is crucial for maintaining trust and the reputation of your tax preparation service.

Utilizing Mobile Solutions: Taxes to Go Mobile App

Embrace mobile solutions like the Taxes to Go mobile app for tax professionals to streamline your workflow further. This app allows clients to securely send tax documents and signatures, reducing the need for physical meetings. Its integration with Keystone Tax Software streamlines the tax preparation process. The app’s chat feature enhances communication, making the tax filing process faster, easier, and more secure.

Now that you know various strategies to increase efficiency in your tax workflow, you can streamline your process for better productivity and client satisfaction. These steps contribute to a more efficient, accurate, and client-friendly tax preparation experience. If you’re ready to elevate your practice, reach out to Keystone Tax Solutions today.