Starting a tax business can be a lucrative venture, especially if you have a knack for numbers and a passion for helping others manage their finances. However, many potential entrepreneurs are deterred by the perceived high startup costs. Read on to find out how to start your own tax business with little money, from establishing your tax preparation business to operating it as affordably as possible, ensuring you launch successfully and grow sustainably.

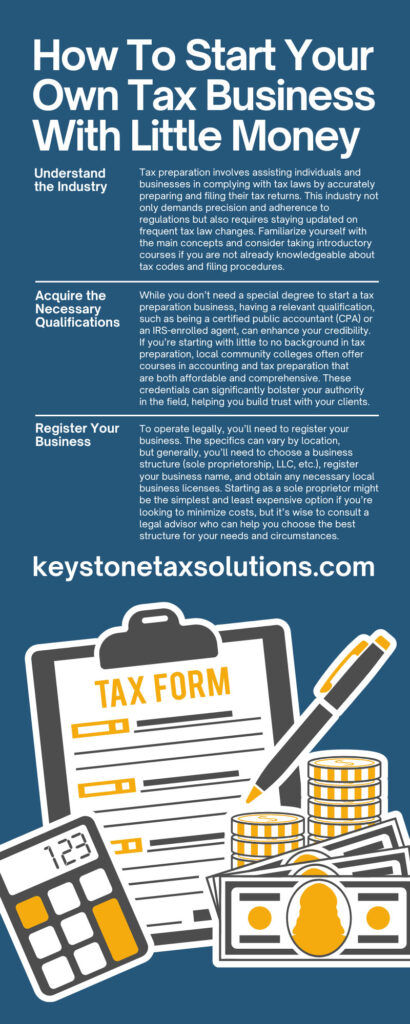

Understand the Industry

Before diving into the tax preparation business, it’s crucial to understand the industry landscape. Tax preparation involves assisting individuals and businesses in complying with tax laws by accurately preparing and filing their tax returns. This industry not only demands precision and adherence to regulations but also requires staying updated on frequent tax law changes. Familiarize yourself with the main concepts and consider taking introductory courses if you are not already knowledgeable about tax codes and filing procedures.

Acquire the Necessary Qualifications

While you don’t need a special degree to start a tax preparation business, having a relevant qualification, such as being a certified public accountant (CPA) or an IRS-enrolled agent, can enhance your credibility. If you’re starting with little to no background in tax preparation, local community colleges often offer courses in accounting and tax preparation that are both affordable and comprehensive. These credentials can significantly bolster your authority in the field, helping you build trust with your clients.

Register Your Business

To operate legally, you’ll need to register your business. The specifics can vary by location, but generally, you’ll need to choose a business structure (sole proprietorship, LLC, etc.), register your business name, and obtain any necessary local business licenses. Starting as a sole proprietor might be the simplest and least expensive option if you’re looking to minimize costs, but it’s wise to consult a legal advisor who can help you choose the best structure for your needs and circumstances.

Obtain an IRS Preparer Tax Identification Number

All paid tax preparers are required to register with the IRS and obtain a preparer tax identification number (PTIN). Fortunately, the process is straightforward; you can apply for a PTIN online through the IRS website, which typically takes about 15 minutes. Having a PTIN not only allows you to prepare federal tax returns legally but also serves as an identification that enhances your professional credibility.

Invest in Professional Tax Preparation Software

Reliable tax software is a cornerstone of a successful tax preparation business. It helps ensure accuracy, compliance, and efficiency in preparing and filing returns. While some software packages can be expensive, there are affordable or even free versions tailored to new small businesses. Consider software that includes features like e-filing, direct client communication, and ongoing support. Initially, look for pay-per-return options or free trials to minimize upfront costs.

Set Up a Home Office

Start your tax business from home to save on overhead costs. Ensure you have a dedicated workspace equipped with a computer, high-speed internet, a reliable printer, and file storage for any necessary documents. A home office reduces your initial expenses by eliminating commercial rent and commuting costs, allowing you to channel more funds into other areas of your business.

Market Your Services Effectively

Effective marketing is crucial to attract your first clients. Utilize social media platforms to reach potential clients by sharing tax tips, important deadlines, and the services you offer. Creating a professional website can also help establish your presence online. Use local advertising, like fliers or local newspaper ads, and network with other local businesses to build your reputation. Referral programs can also be a great way to encourage word-of-mouth promotion.

Offer Competitive Pricing

When starting out, it’s important to attract clients by offering competitive pricing. Research what other tax preparers in your area are charging and consider setting your rates slightly lower to draw in your initial client base. You can always adjust your pricing as you gain more experience and credentials.

Build Relationships With Clients

Client relationships are the backbone of a successful tax preparation business. Focus on providing excellent customer service by being responsive, professional, and transparent. Personal touches like sending reminders for upcoming tax deadlines or providing customized tax-saving tips can make clients feel valued and more likely to return or refer others to your services.

Stay Updated on Tax Laws

Tax laws change frequently, and staying informed is essential to provide accurate and effective service. Subscribe to IRS updates, join professional tax preparation organizations, and participate in relevant webinars and training sessions. Being proactive about your professional development helps you avoid costly errors and enhances your reputation as a knowledgeable provider.

Consider Specializing

As your business grows, consider specializing in specific areas of tax preparation, such as small business taxes, real estate, or non-profit tax filings. Specialization can differentiate your business from competitors and allow you to charge higher rates for your expert services. It also makes your marketing efforts more targeted and effective.

Streamline Your Processes

Efficiency is key to managing multiple clients effectively. Develop streamlined processes for everything from client onboarding to filing returns. Use checklists and templates to ensure no steps are missed. Automating certain aspects of your services, such as appointment scheduling and client reminders, can save you time and reduce errors.

Plan for Seasonal Fluctuations

Tax preparation is a seasonal business, with peak times around tax filing deadlines. Plan your year accordingly, considering how you will manage the workload during peak times and what you will do during off-peak months. Some tax preparers use the slower months to focus on business development, continued education, and networking.

Expand Through Partnerships

Once established, consider expanding your business through partnerships. For example, a tax preparation partnership with no EFIN required can allow you to work under the umbrella of another preparer or firm. This can provide you with opportunities to handle more complex returns or serve additional clients without substantial increases in overhead.

By understanding how to start your own tax business with little money, you can enter the tax preparation industry with confidence. Keep your focus on quality service and continuous learning to maintain and expand your client base. With careful planning and dedication, your tax preparation business can thrive, providing valuable services to clients and a rewarding career for yourself.