The Best Things About Working Tax Preparer

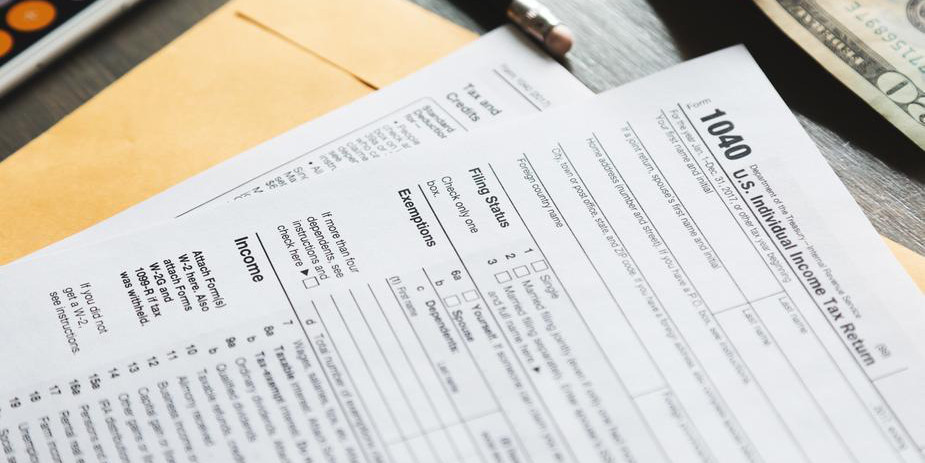

The tax season can be a daunting and exhausting time for many adults due to the complexity of tax laws. Instead of filing through the paperwork themselves, some people prefer to leave Working Tax Preparer work to those who know how to do it to avoid the stress. This is where the help of Working Tax Preparers comes in handy! Working Tax preparers are in charge of just that—preparing taxes. With their experience and expertise, they ensure that their clients pay the required amount to the government. Doing others’ taxes may sound like a nightmare to others, but as stressful as people think taxes are, you might be surprised how good of a job working as a tax preparer can be! Here are a few of the many advantages of working as a tax preparer in America: #1 You’re Always Growing and Learning Unlike other jobs that have similar tasks every day where you work on the same types of jobs repeatedly, tax preparation is in no way monotonous! You will never run out of unique scenarios. You never know what kind of situation you may run into, so you’re always kept on your toes while constantly learning about the latest best practices and laws in the field. #2 You’ll Never Run Out of Work The future for Working Tax Preparers is bright! The demand for tax preparation services is only expected to go up, according to Recruiter.com. People will never stop paying taxes, which means you’ll never run out of clients who need help preparing their tax returns. Even if you’re not a full-time Working Tax Preparer, you’re sure to have solid employment from January to April. #3 Tax Preparation Is Simple There may be many guidelines and regulations to master, but the work is daily easy to manage. There are multiple professional tax preparation software programs available to help you, so you won’t feel like you’re doing everything alone! Having technological assistance will make your life much easier, so you can still enjoy your job. #4 Preparing Taxes Is Fulfilling Many see doing taxes as tedious, complicated, and something you need to get over with so you can continue with your life. On the contrary, preparing taxes is a fulfilling job because you have the opportunity to help a diverse group of people solve their filing problems and maximize their returns. By preparing taxes, you’re contributing to the public good and giving your clients peace of mind that they’re compliant. #5 You’ll Have a Flexible Work Schedule Since the IRS requires American citizens to pay for their federal income taxes by April 15, they’ll need tax preparation services during the months leading to this date. You’ll be the busiest during the spring, but you’ll be mostly free the rest of the year. There may be off-peak work, but besides that, you’re free to do whatever you please—you can either explore other career opportunities or just relax at home. Conclusion Working as a professional tax preparer is just as exciting and fulfilling as any other job! If you have the knack for crunching numbers and learning about tax laws, then this might be just for you! As long as you know the right people, have the necessary skills and use the best professional tax software, you’re sure to succeed in this industry! Star your tax business with Keystone Tax Solutions! We are a leader in the professional tax software industry, offering 100% web-based tax software while helping thousands of tax professionals gain access to affordable technology-driven professional tax preparation software. Get your free demo now!