Audit Benefits Protection About

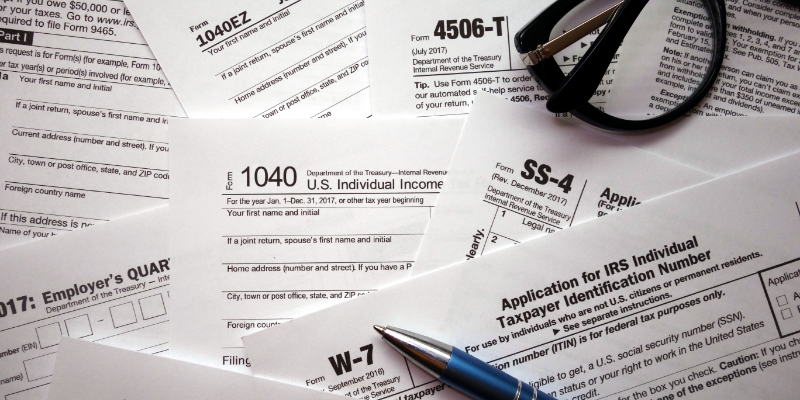

If you’re part of a business or a household, the odds of Benefits Audit Protection by the IRS are little to none. Although the actual audit process can be intimidating, it’s also necessary for the IRS to conduct. The agency relies on taxpayer information when conducting audits protection benefits, and it’s also a way to ensure the tax code is enforced and that those who don’t pay their fair share do so. Unfortunately, taxpayers don’t always come to the IRS prepared for an audit. We saw that in a report from The National Taxpayer Advocate of the Internal Revenue Service, which revealed that taxpayers may need to be better prepared for an audit than they are now. The good news is that this is possible thanks to one thing: Benefits Audit Protection. In this article, we’ll go into detail about Benefits Audit Protection. Read on below to learn more. To Know Benefits Audit Protection Benefits Audit Protection services help taxpayers respond to IRS requests for information, including requests for documentation, interviews, and legal representation. The audit process is complex and confusing, and even taxpayers who have done everything right can trigger an audit. That’s when they need Benefits Audit Protection services most. However, just because taxpayers may have Benefits Audit Protection doesn’t mean they completely understand what is at stake during an audit. That’s why it’s essential to know how audit protection services work, including their limitations. Taxpayers can turn to their representatives for help navigating the audit process, but it’s essential to know that audit protection services aren’t always free. Taxpayers can work with licensed tax professionals to receive audit protection services. These professionals can be lawyers or CPAs who can provide valuable support in the event of an audit. The IRS also has its own version of audit protection services—and they’re free. Who Can Give Benefits Audit Protection Services? Taxpayers might think that Benefits Audit Protection services are only available from paid representatives, like licensed attorneys and CPAs. The IRS offers a free service called Representation Services that provides taxpayers with a representative to help with appeals and audits. But it does have limitations, the most notable of which is that it’s only available to low-income taxpayers. Taxpayers who make $52,000 or less may qualify for Representation Services. Taxpayers who do not qualify may seek audit protection services from third parties. There are two types of tax professionals who can provide Benefits Audit Protection services, either lawyers or Certified Public Accountants (CPAs). The Benefits Audit Protection Benefits Audit Protection is a service that many people employ simply because it offers the following benefits: Saves You Money Any IRS issue takes a lot of time to resolve. You’ll save a lot of money if you have a professional managing everything for you. Saves Time No matter how minuscule an IRS notice may be, it will take hours upon hours to finish everything because there are many things to do, such as collecting the required documents and constantly communicating with the IRS. Gives You Peace of Mind As mentioned earlier, an audit notice from the IRS is intimidating, which can undeniably cause a great deal of anxiety. If you have a professional working alongside you, you can rest easy knowing that they will help you resolve your tax issues. Other Things to Remember You can buy audit defense for a single year or multiple years. If you purchase audit representation for one year, you must buy another year to continue receiving protection. If you don’t file your taxes with a tax-preparer or if your tax-preparer recommends you buy audit defense or representation, you must still sign the tax return and be responsible for the accuracy of the return. If the IRS challenges it, you’ll be in the same boat as if you’d hired a tax-preparer and had a professional review the return. If you’re audited, you’ll pay a fee that starts at $200 and goes up depending on the amount you owe. If the IRS disagrees with your numbers and sends you a bill, you may end up with a balance due that’s higher than your tax refund. Conclusion Getting a notice from the IRS can be stressful, but you can lessen some of the hassles by getting an audit protection service. As long as you have it and you comply with the instructions laid out by the IRS, you won’t have any problems. Keystone Tax Solutions has the best professional tax preparation software that can help with your audit protection. We understand how hard it can be when you get a notice from the IRS, which is why we will do the work for you. Contact us today to learn more!